Last offshore wind turbine parts leave New London

Greg Smith

New London ― And then there were none.

Less than a year after the offshore wind industry landed in

New London with the delivery of components for the nation’s first utility-scale

offshore wind farm, the final pieces of New York’s South Fork Wind slowly made

their way by barge up the Thames River on Friday night.

The parts, which include 330-foot-long turbine blades,

520-metric-ton nacelles and pieces of towers that when completed will rise 800

feet in height, were headed 35 miles off the coast of Montauk, N.Y., to the

12-turbine wind farm.

"It has been immensely gratifying to see the assembly

and delivery of South Fork Wind turbines come to completion under the intended

scenario for the transformed State Pier,” Ulysses Hammond, executive director

of the Connecticut Port Authority, said on Friday.

South Fork Wind, a joint venture between Danish wind company

Ørsted and Eversource, is on track to be completed by the end of the month,

delivering 132 megawatts of power to the East Hampton, N.Y., power grid, enough

to power an estimated 70,000 homes. One megawatt can power about 500 homes.

The last barge loaded with components left State Pier at 6

p.m. New London Mayor Michael Passero said he would likely be able to catch a

glimpse of the barge moving down the Thames while having dinner at On the

Waterfront restaurant.

Prior to his election as mayor in 2015, Passero said he

never would have predicted the $309 million transformation of State Pier or

that New London would become a centerpiece for the country’s burgeoning

offshore wind industry.

Aside from a $1 million annual financial boost to the city

through a host community agreement and other revenue-sharing benefits, Passero

said there is a certain prestige to being the center of attention.

“It just raises the profile of New London and helps put us

back on the map the way the whaling era put us on the map,” Passero said.

Greg Smith

New London ― And then there were none.

Less than a year after the offshore wind industry landed in

New London with the delivery of components for the nation’s first utility-scale

offshore wind farm, the final pieces of New York’s South Fork Wind slowly made

their way by barge up the Thames River on Friday night.

The parts, which include 330-foot-long turbine blades,

520-metric-ton nacelles and pieces of towers that when completed will rise 800

feet in height, were headed 35 miles off the coast of Montauk, N.Y., to the

12-turbine wind farm.

"It has been immensely gratifying to see the assembly

and delivery of South Fork Wind turbines come to completion under the intended

scenario for the transformed State Pier,” Ulysses Hammond, executive director

of the Connecticut Port Authority, said on Friday.

South Fork Wind, a joint venture between Danish wind company

Ørsted and Eversource, is on track to be completed by the end of the month,

delivering 132 megawatts of power to the East Hampton, N.Y., power grid, enough

to power an estimated 70,000 homes. One megawatt can power about 500 homes.

The last barge loaded with components left State Pier at 6

p.m. New London Mayor Michael Passero said he would likely be able to catch a

glimpse of the barge moving down the Thames while having dinner at On the

Waterfront restaurant.

Prior to his election as mayor in 2015, Passero said he

never would have predicted the $309 million transformation of State Pier or

that New London would become a centerpiece for the country’s burgeoning

offshore wind industry.

Aside from a $1 million annual financial boost to the city

through a host community agreement and other revenue-sharing benefits, Passero

said there is a certain prestige to being the center of attention.

“It just raises the profile of New London and helps put us

back on the map the way the whaling era put us on the map,” Passero said.

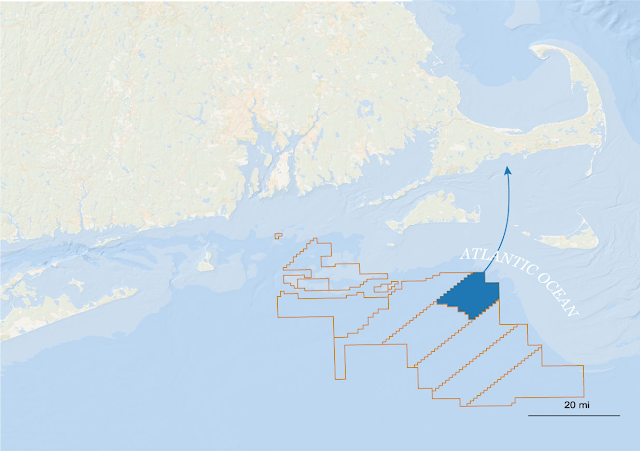

South Fork Wind

MASSACHUSETTS

Delivered its first jolt of power to Long Island, N.Y., Dec.

6. When completed this spring, it’s 12 turbines will supply enough electricity

to light 70,000 homes.

Cape Cod

RHODE

ISLAND

CONNECTICUT

New London

Long Island

Wainscott

The Bureau of Ocean Energy Management wind lease areas are shown in orange

Map: Scott Ritter/The Day | Data: BOEM; South Fork Wind;

ESRI

What’s next at State Pier?

With the last wind turbine parts cleared from State Pier,

Hammond said work would continue to complete the construction project, which is

overseen by the port authority. Dredging is currently underway and on track for

completion this month, he said. Work is also ongoing on one of two new

heavy-lift platforms.

Hammond said the objective this quarter is to turn over 100%

of the site to port operator Gateway Terminal for the next project, Revolution

Wind.

As it did for South Fork, State Pier will be the staging and

pre-assembly area for Revolution Wind, a wind farm nearly six times the size of

South Fork Wind, with 65 turbines situated 15 nautical miles southeast of Point

Judith, R.I. Revolution Wind will be the first wind farm to bring renewable

power to Connecticut. The joint venture of Ørsted and Eversource will generate

704 megawatts of power -- 304 megawatts to Connecticut and 400 to Rhode Island.

Hammond said Gateway will use the experience gained from

South Fork Wind “to continue the smooth operation that Gateway Terminal

established over the past several months.”

Downturn in offshore wind industry

Ørsted, which canceled two other planned wind projects in

the U.S. last year and announced plans to cut jobs earlier this month, said it

remains committed to the Revolution Wind project. The offshore wind industry

has been hit by a series of setbacks that offshore wind developers blame on

increased costs associated with higher interest rates and supply chain

disruptions. Ørsted was among several developers to cancel contracts in the

Northeast because of increased costs.

In a statement on Friday, Ørsted said onshore work for

Revolution Wind “continues to steadily progress and we anticipate components

for the project to begin arriving at State Pier this spring.”

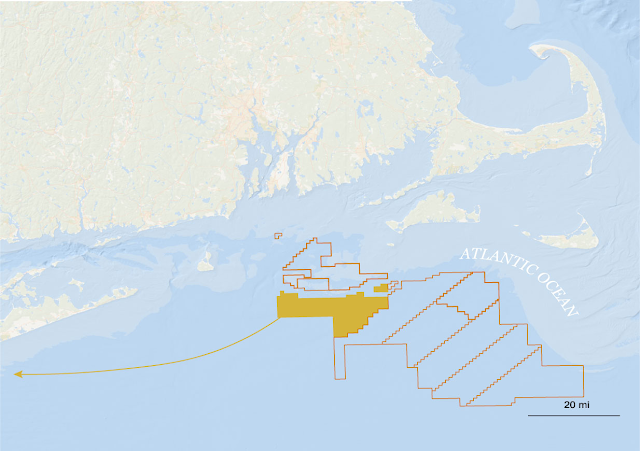

Vineyard Wind

MASSACHUSETTS

Its first turbine began sending power to the electric grid

at 11:52 p.m. Jan. 2. Once completed, 62 wind towers will churn out enough

power for around 400,000 homes.

Cape Cod

Barnstable

RHODE

ISLAND

CONNECTICUT

New London

Long Island

The Bureau of Ocean Energy Management wind lease areas are

shown in orange

Map: Scott Ritter/The Day | Data: BOEM; Vineyard Wind; ESRI

Eversource announced last year it was exiting the offshore

wind industry and selling its stake in the joint projects with Ørsted.

Eversource has since announced it had an agreement to sell

its 50% ownership share in both South Fork and Revolution Wind to Global

Infrastructure Partners, exiting the projects while “retaining certain cost

sharing obligations for the construction of Revolution Wind.”

Eversource said it expects to enter into a separate

construction management agreement as a contractor for Revolution Wind to

complete the onshore work that is already underway.

Ørsted has rebid its Sunrise Wind project, also in New York,

as part of New York’s latest offshore wind solicitation. As part of the newest

proposal, Ørsted has agreed to acquire Eversource’s 50% share of the planned

924-megawatt farm.

By comparison, Dominion’s nuclear power plant, Millstone

Power Station in Waterford, generates more than 2,000 megawatts and powers

about 2 million homes.

Planning for the next project

For Revolution Wind, Hammond said wind turbine components

will come in incrementally and be stored, partially assembled and shipped to

the Revolution Wind site -- just as they were for South Fork Wind -- on a

continuous rotation of incoming and outgoing vessels carrying components until

the project is completed.

The project was originally supposed to make use of the first

U.S.-built and Jones Act-compliant offshore wind turbine installation vessel,

called Charybis. Construction of Charybis, however, is still underway. Dominion

Energy, the owner of the massive, 472-foot-long ship, has announced the vessel

will not be ready until the end of 2024 or early in 2025.

Tony Sheridan, president of the Chamber of Commerce of

Eastern Connecticut, said it’s exciting to have the region “front and center of

a new industry, new to America.” Sheridan traveled to Denmark last spring in

hopes of luring wind turbine manufacturers to the U.S. He sees a future in

manufacturing tied to the maritime industry.

Sheridan said there are good jobs associated with the

industry, and in light of the expense of the cost to develop State Pier, thinks

the state and Gov. Ned Lamont are rightly looking ahead.

Revolution Wind

MASSACHUSETTS

Some 65 turbines could be turning by next year. About 400

megawatts of power is expected to flow to Rhode Island; 304 megawatts would be

purchased by Connecticut consumers.

Cape Cod

RHODE

ISLAND

Quonset Point

*

CONNECTICUT

New London

Long Island

The Bureau of Ocean Energy Management wind lease areas are

shown in orange

Map: Scott Ritter/The Day | Data: BOEM; Revolution Wind;

ESRI

Hammond also credited the governor and state leaders for

“putting the Port of New London and State Pier at the forefront of this new

American industry delivering clean, sustainable, domestic offshore wind

energy.”

“I came out of retirement to see this project through and I

am over the moon about what the citizens of Connecticut and our Partners have

accomplished. We are the country's example of what's possible when it comes to

the decarbonization of our nation,” he said.

Lamont Launches an Offshore Wind Collaborative

Gregory Stroud

GROTON – It’s almost unfair to frame an interview of the

just launched Connecticut Wind Collaborative in a litany of bad

news – some might call it a reality check. Not an hour after I began

writing this story, the news broke that Ørsted was pulling out of offshore wind

markets in Norway, Spain and Portugal – what the Financial

Times is calling a “retreat after several years of aggressive

expansion.”

That’s quite a change from five years ago, when Ørsted made

a splash across

the Eastern Seaboard and in New London by venturing into what was then valued

conservatively as a 20GW, $70B offshore wind market. Since then, Ørsted share

prices have dropped by a quarter, and are off 70% from highs three years ago.

Ørsted which began as a state-owned producer of oil and

natural gas, is still the world’s largest developer of offshore wind and

controls about a quarter of the world market. Ørsted also remains a big player

in Connecticut, where it is doubling down with buyouts of partnering

Eversource, and pushing ahead with projects out of State Pier even as it

cancels planned wind farms off New Jersey.

Analysts say the

company “now needs to execute on various components of its plan,” which for

southern New England means completing Revolution Wind, a 704 MW offshore wind

farm being staged out of State Pier in New London, and contracted to provide

power to Connecticut and Rhode Island.

In an uncertain world these contracts – what the industry

calls power purchase agreements or PPAs – provide revenue certainty, a

guaranteed price to reassure developers like Ørsted to invest billions of

dollars in ports and vessels and turbines before seeing a dime of profits.

But PPAs have lately been a sticking point for the

completion of Sunrise Wind, a 924 MW project scheduled for staging out of State

Pier, and Ørsted has threatened to pull out of the project without a higher

guaranteed price than its original bid.

Avangrid, a subsidiary of the Spanish multinational

Iberdrola, has already pulled the plug on the Park City Wind project out of

Bridgeport – a result that frankly surprised no one, given what looks now like

a highly speculative low bid in 2019 for the energy.

Exiting that contract cost Avangrid a mere $16 million, a

tiny fraction of the project cost, a result that State Sen. Ryan Fazio,

R-Greenwich, the ranking Senate Republican on the Energy Committee, compared to

a “heads, I win, tails, you lose,” scenario for consumers.

New bids for offshore projects, including Sunrise Wind, once

scheduled for Jan. 31 have been delayed in part to give time for the IRS

to clarify the

availability of substantial federal tax credits, and are expected to come in at

a significant premium.

High interest rates, a balky supply chain, the halting

availability of tax credits and subsidies – nearly everything that could go

wrong for wind energy has gone wrong. And the partisan divide that has

overtaken the sprint toward an electrified economy in the United States surely

adds a risk premium.

Not backing away

All that said, Gov. Ned Lamont and the State of Connecticut

aren’t backing away from the goal of a 100% zero-carbon electricity supply by

2040.

Instead in October, just as the first wave of really bad

industry news hit, the administration was announcing an ambitious 24-page road

map for a multi-state cooperative effort to build an offshore wind

industry, and the launch of a 501 (c) (3) nonprofit, the Connecticut Wind

Collaborative, to help coordinate and implement it.

Paul Lavoie, chair of the Connecticut Wind Collaborative (CT

Examiner)

I met with members of the collaborative earlier this month.

The board chair, Paul Lavoie, is the state’s Chief Manufacturing

Officer.

Leaving

his job at the Connecticut Port Authority, Andrew Lavigne, the co-vice

chair for the collaborative, was named last March, manager of the Clean Economy

Program at the Department of Economic and Community Development.

Paul Whitescarver, the former Commanding Officer of the

Naval Submarine Base New London, is the secretary and incorporator.

Whitescarver is the executive director of the nonprofit Southeastern

Connecticut Enterprise Region, or seCTer,

where the nonprofit collaborative is being incubated.

The Connecticut Wind Collaborative launches with $577,500 of

seed funding from the Ørsted and Eversource joint venture in part to fulfill

contractual commitments to support supply chain and workforce development tied

to Revolution Wind. With this funding in place, the collaborative is expecting

to hire a full-time executive director as soon as April, with a longer-term

goal of organizational budgets in the low millions of dollars.

Getting serious about offshore wind

Dial it back a year to April 2023.

Lavoie, who had been tapped in late 2022 to lead the state’s

efforts on offshore wind, had just hired Lavigne. Not much was happening

offshore. Lavoie had been sending reports upstairs through Nick Simmons,

Lamont’s newly appointed Deputy Chief of Staff, when by Lavoie’s account, word

came down from the Governor that he wanted a strategic plan for offshore wind

by August.

Andrew Lavigne, manager of the Clean Economy Program at DECD

(CT Examiner)

Here Paul Lavoie narrates how it happened…

PL: We were really just kind of maintaining what we

were doing in the offshore wind industry — They’re still working on the pier.

Nothing was being marshaled yet. They were talking about some Southfork coming

here. Revolution was still not financed yet.

So, you know, it was up in the air.

And then we brought Andrew on board. And right around that time, there was a

deputy chief of staff in the Governor’s Office that had a keen interest in

offshore wind, that really came through the governor and through him. And I

started giving him updates on the offshore wind industry and what was going on.

Andrew was “born” in April and he came to me in late May. Actually, I called

Andrew into my office and I said, “I just got a call from the Governor’s

Office. He wants a strategic plan on offshore wind, and he wants it by August.”

June, July, August… we had, like, three months. So, Andrew’s comment

was, “You mean all the justification that I did, that we should put

together a strategic plan?”

So you can throw it away. It’s the Governor. The Governor wants it. Now we’re

going to do it.

So you can really look at that as being the date that Connecticut got very

serious about offshore wind and the offshore wind industry, when the Governor

asked us to do that, under Nick Simmons’ direction, who was the Deputy Chief of

Staff at the time.

The roadmap that came together over those three months was

based around four pillars: maximizing ports and infrastructure, building the

necessary workforce, building a supply chain, and maximizing the state’s

research and development capabilities around offshore wind and the “blue

economy.”

PL: Building the strategic roadmap was basically

putting our stamp saying, “Connecticut is in the offshore wind industry, we’re

very, very serious about it, and we’re going to resource it to be able to make

sure that we can do four things right.”

State officials launch a privately-funded nonprofit

With $577,500 of private seed money, a number of state

officials, including Lavoie and Lavigne, worked with Whitescarver to

incorporate the Connecticut Wind Collaborative as a 501 (c)(3) nonprofit.

By all accounts it was an unusual, perhaps unprecedented solution.

PL: We finished it in August and then the Governor

didn’t roll out till October. So you can look at October as when Connecticut

said, “Okay, you know, here we go.” And part of that plan is the creation of

the Connecticut Wind Collaborative, which is a nonprofit organization that will

support the offshore wind industry.

We did that intentionally, setting it up as a nonprofit organization. Right now

it’s funded with money from Revolution Wind, money that was set aside for

economic development that was being unused. So, we repurposed that money to go

into the wind collaborative. And we’re going to look at the industry to be able

to say, “Listen, we want you to support the wind collaborative as well.”

We’re going to look at this as really being privately funded. And then we’ll

look at the public part of it once we get it up and running, because we’re

going to need some kind of incentives to be able to grow the industry.

I don’t think anyone ever said, “Connecticut needs another

quasi-public,” like the often beleaguered Connecticut Port Authority, but the

nonprofit arrangement raises a variety of ethical and legal questions of its

own.

Boil it down and we have government officials setting up a

nonprofit entity and accepting private money as a vehicle to perform the very

same public duties they are paid for by the taxpayers — all outside of the

bounds of ethics rules, public meetings law, and Freedom of Information

requests.

GS: So, from a cynical press perspective, so we have a lot

of public officials sitting around in a nonprofit, and I can’t FOIA them, or

have any access to these conversations?

PL: I think the whole idea of a nonprofit is about

speed, right? It really is about speed and how quickly we can move, and how we

can bring other entities together to look and say, “Hey, listen, we want to do

this from a win-win perspective.”

You know, what’s interesting is that we’re looking at, you know, we’re trying

to orchestrate a brand new industry.

You’re talking about where’s the tipping point, right? Where’s the point where

we’re, all of a sudden, we’re gonna get to a critical mass of installations

where it’s no longer economically going to make sense to bring stuff over.

But how do we manage up to that, so that when we hit that tipping point we can

capitalize it right away?

I’ll tell you my fear. My biggest fear when I stepped into this role was that

we were behind. We were way behind. And we’ve caught up.

GS: Or everything has slowed down.

PL: Well both, right?

Yeah, but it has slowed down a little bit, and we’re playing catch up, but I

think we’re at the point right now that we’re going to step ahead of where

industry is and be able to look at that strategically and say, “Okay, where are

the areas that make sense in Connecticut?”

And, again, regionally too. Where does that all make sense?

So, the idea of the plan is that when we get to that point, we’ve got workforce

training in place, we’ve got suppliers ready to take on the work we have. And

it really is going to them and saying, “Listen, you know, there’s no work

today, but here’s what the work is going to be like. So start planning your

organization to take the work.”

And there’ll be some that will, and some that won’t, and we want to be able to,

to capitalize on that.

But we want to build out the supply chain here first, and then we can fill the

gaps in.

There’s gonna be direct foreign investment. There’s going to be European

companies that are out there saying, “Hey, we want to put a plant Connecticut,”

because rather than having Connecticut people make it, we want our people to

make it and we want to make it Connecticut.

Well, that’s going to be Connecticut jobs, right? Those are going to be

Connecticut jobs, Connecticut capital equipment, Connecticut real estate. All

of that.

So we’re looking at how we balance all of that. We’re trying to get an entire

ecosystem ready for an industry. And the collaborative will be at the center of

this.

GS: I think there are two things when the public hears about

something like this. One, is they worry that when the government gets involved

in these sorts of these things, that they’re picking winners. But it doesn’t

really seem like that’s what you guys are are doing, it’s more of a clearing

house than picking.

PL: That’s a fair statement.

GS: The other, again, that point of transparency. You know,

I’d be more worried about transparency, if you were picking winners, but still,

why not a quasi-public? Why not give us that extra measure where we can sit in

on your board meeting, where we can potentially do a Freedom of Information

request?

Not to use the Port Authority as a model. But, thank God, in that sense, I

think the public has benefited from the fact that the Port Authority is a

quasi-public. That transparency, ultimately, was a winner. So why a nonprofit?

Are there a lot of other nonprofits like this that the state sets up?

PL: You know, I don’t know that I’m aware of any of

them. Again, this was really all designed around, “how do we engage with

private industry, and how do we get this running as quickly as we possibly can.

It’s easier from a funding perspective. It’s easier standing it up and getting

things done. We’re doing an RFP for branding. And we put the job out there

already. We’re already getting applicants. About three weeks from now we’re

gonna start interviewing candidates.

It doesn’t happen that way. If it was a quasi-public it wouldn’t move that way.

So, it gives us that flexibility to do it. And listen, I know, quite frankly,

I’m serving as the board chair because, with Andrew, we’re the most

knowledgeable people. I serve a year or two, and somebody from private industry

is interested in being the board chair, that’s great.

But, yeah, I think that’s an issue of consideration for us to take as the board

to say, “How do we become more transparent? How do we make sure that we’re

guaranteeing transparency?”

You know, and I don’t have I don’t have any problem with that.

The tipping point

In October, at the initial rollout of the state’s offshore

wind roadmap, I was struck by the extraordinarily modest the number of skilled

jobs and manufacturing opportunities I was being pitched by state officials —

dozens of jobs, screws and fasteners.

By that measure, in the fall, offshore wind was all about

low-carbon energy generation.

Paul Whitescarver, executive director of seCTer (CT

Examiner)

In contrast on Wednesday, the conversation centered much

more on business, supply chains and manufacturing, particularly the idea that

the logistical challenge of foreign companies installing thousands of wind

turbines off the coast of New England was monumental enough to drive the

developers like Ørsted to look to the domestic American market for components,

repairs and replacements.

By Whitescarver’s back of a napkin estimation, we’re talking

2,500 wind turbines out of a just a handful of ports on the east coast.

PL: Connecticut has the only pier with unrestricted

access to open water to offshore wind farms. New Bedford has the hurricane

barriers. But those are the only two ports right now that are that are

marshalling offshore wind projects in the country. New York’s building them.

New Jersey’s building them. Everybody’s trying to build up for that, but we

have the head start.

And you’re right, I mean, all of the the work is coming from overseas, but I’ve

had conversations with purchasing folks at Ørsted. Now, they’ve opened up a

container, looked at the container, and said, “Every part that’s in that

container can be made here.”

So, there’s going to be an economic decision that developers are going to make

that says, it’s no longer economically viable to make this stuff in Europe and

then to ship it in a container over here, when it can be made here. And so

we’ll we’ll be ready to help build out that supply chain.

We’re looking at it not on a state-by-state basis, we’re looking at a regional

basis. How do we build a regional economy?

So far it appears that the idea of collaboration appeals

most to neighboring Rhode Island. Already a member of Rhode Island Commerce has

joined the board, and the collaborative is engaging with the North Kingstown

Chamber of Commerce to bring its WindWinRI educational

pipeline program to Connecticut high schools and colleges.

PW: Paul [Lavoie] and I were at the same conference,

and we listen to this guy talk about the U.K. and their development of offshore

wind, and how the developers when you work with the U.K., you don’t have to go

to eight or nine different states to figure out how to do things. So this

collaborative that the state has started is really an answer to that.

And all the developers when you go to the conferences have complained about the

requirements for local content and how going across state lines makes it very

difficult. Because Connecticut maybe only has a small power purchase agreement

compared to say New York, and you have a New York that’s got a local content

requirement compared to a little bitty old Connecticut.

So with the collaborative, when we can unify ourselves with Rhode Island and

Massachusetts, you get rid of that local content — it can’t go across state

lines, but regionally it makes sense. That is where the collaborative and our

association with the other states will make a difference.

What Connecticut does best

But if Lavoie and Whitescarver offered scant evidence, yet,

of any significant out-of-state buy-in, or any collaborative counterbalance to

the shear weight of neighboring New York, they made a more convincing case that

Connecticut’s manufacturing niche — aircraft, engines and submarines — is an

especially good fit for offshore wind.

GS: I mean, part of the reason to collaborate is right now

we’re talking dozens of jobs, right? We’re not talking hundreds of jobs, or

several hundreds of jobs. Part of that is that we’re starting small, right?

There’s a little bit of hurry up and wait here.

PW: So, you know, when seCTer did their offshore wind

industry cluster development for the [Economic Development Administration] for

the Build Back Better regional challenge, we did a REMI study.

And through a course of a decade, if you were to bring the supply chain to

Connecticut or Rhode Island, if we could have gotten $60 million, whether for

UConn, for workforce investment, for finding pieces of property, you could have

an apex of jobs created of about 9,000 over a decade with an equilibrium of

about 6000 jobs created. And that was just looking at southeastern Connecticut.

So the jobs will come. There are plenty of studies that corroborate that.

GS: So we have a collaboration between the states. Besides a

port, what specifically does Connecticut bring to the table? And what should we

bring to the table better? Like, when they say, “Okay, you do this, we do

that.” What do we do? What do we want to do?

PL: We have one of the most sophisticated supply chains

around three areas, right?

Helicopters, jet engines, and submarines.

So when you really look at, “what is a windmill?” It’s a propeller that’s

powered by an engine that’s on a really long round thing, right? What we are

really looking at is the components piece of that.

Are we going to make the stanchions here? We have the capability to do it, but

that’s being done in Europe.

But when you start to take a look at the engine and the components in the

engine, and you start to look at wear and tear and breakdown — all of those

component parts can be made here and the supply chain is ready to do it.

Because they’re making parts right now for F135 engines and commercial engines.

And Connecticut is number one in the country in aircraft engine and airplane

parts manufacturing. 25% of all aircraft engines and airplane parts are made

here in Connecticut.

So you look at that. That infrastructure exists. It literally is a bolt on to

that infrastructure. It really is the understanding and the capability to do

that.

And then you look at at maintenance and repair organizations. There are

maintenance and repair organizations across the state for propeller blades, and

for engines, and all of that. So, as we look at the supply chain, right now, we

really need to get companies to understand what that’s going to be. And that

requires somebody to work with the developers and to work with the tier-one

suppliers like Siemens Gamesa. We’re working to get them to understand what

they’re going to need for components and connecting them to Connecticut

companies. So, that’s Connecticut’s strategic advantage.

Fairfield OKs 5-story mixed use development on Black Rock; contaminated soil still needs cleaned

FAIRFIELD — A project to transform the abandoned lot

where Fairfield's Bullard Machine Tool Company factory once stood and turn it

into a large-scale development with apartments, shops and co-working

space has secured zoning clearance from the town.

Zoning

commissioners signed off on plans to build a five-story building with 245

apartments, including 30 affordable units, ground-floor retail space and

co-working offices for residents at 81 Black Rock Turnpike, tucked between

Fairfield Metro Center and the newly

opened Elicit Brewing Company location. The zoning approval is a major step

forward for the large-scale development, which still faces a

state-regulated remediation process to clean up environmental contamination

from the old factory at the site.

"I remember going to the train station and driving by

this vacant lot with weeds pulled up and knowing the environmental

concerns and thinking, 'Well that's going to stay there forever. Who's

going to touch that?'" Thomas Noonan, the chair of the commission, said

during a meeting Tuesday. "Now we've got a great project that meets the

criteria from a local builder who's certainly not rushing through it."

The project dovetails with the town's push

to revitalize the neighborhoods surrounding transit centers, like the

Fairfield Metro and Fairfield Station stops on the Metro-North line, with more

housing and commercial space to promote economic activity, mobility and foot

traffic.

"While there's certainly a need for homes throughout

Fairfield — it's not just where density exists — I think we do have a

responsibility to add density where we have infrastructure to support it like

we do here," commissioner Tom Corsillo said.

The approval from Fairfield's Town Plan and Zoning

Commission comes more than a year after Fairfield-based developer Post Road

Residential introduced

its plans in late 2022. The project has since received

a $3 million state grant to cover the environmental remediation

work — funding that the town and developer are contemplating

rejecting due to its legal obligations, which involve more

affordability and higher wages during construction.

The commission backed the development 6-1, with the sole

vote of opposition coming from commissioner Kathryn Braun, who criticized a

lack of clarity surrounding the environmental contamination at the site, as did

commissioner Alexis Harrison despite voting in favor of the development.

With the developer yet to apply to the Department of Energy

and Environmental Protection for the remediation, Braun said the state-governed

process could alter project design, which should be cemented before the

commission grants approval. She said the commission also received too much

information after the closure of the project's public hearing, when

commissioners can question the applicant, leaving her with unanswered questions

for the Engineering Department.

"I think it is not good for the public or for the

commission to not be able to vet out info when it comes in," Braun said.

Noonan rejected Braun's concerns, which he said go beyond

the zoning commission's jurisdiction when it comes to environmental remediation

that DEEP will oversee. He, alongside a pair of other commissioners, said the

state process would vet an exhaustive site cleanup before

construction could move forward, and the town zoning body would remain at

the ready for any necessary issues that come up along the way.

"I'll repeat my lovely saying — people may want

treatises, and they get bullet points — but I don’t really understand what else

is expected of our town engineers or other staff other than we approve, we've

reviewed this, we've talked and we approved it," he said.

New plan to save The Sherman School would reduce building size by about 30 percent

SHERMAN — School officials have developed a plan to renovate

the outdated Sherman School that would reduce the square footage of

the building by about 30 percent.

The proposed square footage of about 59,000 is the most

efficient size to maintain a pre-K-8 school, school officials said. A

prior $47

million plan to upgrade and reduce the building from about 85,000

square feet to about 68,000 square feet was voted

down in October 2023.

The 86-year-old building is in such poor

shape that local officials have weighed whether to close it as

enrollment declines. There is no plan to close Sherman School entirely,

officials said.

“The request that we all got from the town was to sharpen

our pencils. This plan reflects that sharpening,” said Board of Education

member Tim Laughlin at a recent meeting. “It is essentially the

smallest, most efficient building plan that you can have to accommodate the

current educational program for students in pre-K-8 that’s reflected not only

in the building plan, but frankly, also in

the budget the superintendent proposed.”

The Board of Education doesn’t have a cost estimate yet

of the new plan, Laughlin said, adding it would likely be cheaper than the

previous plan.

"We do understand school construction prices have

become more stable in recent weeks, based on other projects' bidding

results,” he said. “It would be fair to assume that a reduction in size and

scope would have a corresponding reduction in project cost and associated

impact to taxpayers.”

Sherman First Selectman Don Lowe told Hearst Connecticut

Media on Thursday he looks forward “to examining the situation at the school

and to working to make The Sherman School whole again in a way that’s

acceptable to the Sherman taxpayers.”

At the Feb. 7 meeting, the Board of Education unanimously voted to send the revised space plan to the school building committee, which meets Tuesday. At the joint meeting, which will be held with the Board of Education and the Board of Selectmen who also acts as Sherman’s Board of Finance, next steps will be discussed.

Reconfiguring classrooms, bathrooms

There are about 250 students in grades pre-K-8 in The

Sherman School this year and about 130 high school students who attend school

in neighboring communities, according to figures presented at the

meeting.

According to enrollment projections from the school, in the

2024-25 school year, there’ll be about 240 students in pre-K-8 and about 140

high school students. Over the next 10 years, however, enrollment in grades

pre-K-8 is anticipated to increase by 60 students, with about 100 students in

grades 9-12.

Under the new plan, pre-k through fourth grade would be

upstairs, while fifth through eighth grade would be downstairs. Fifth graders

are upstairs with the younger kids at the existing school.

“Because the fifth graders would be part of the middle

school, they wouldn’t need independent classrooms,” said Board of Education

Chair Matt Vogt, who is also on the school’s building committee. “In the

middle schools, the rooms are multi-use — more like a college campus where

teachers move between rooms rather than having dedicated classrooms.”

Additionally, the plan calls for pre-K students having

bathrooms in their own classroom.

Other changes would include eliminating gym locker rooms,

reducing storage and office space, and reducing and combining educational

technology and STEAM (science, technology, engineering, and mathematics)

instruction spaces.

“Essentially, everything would be condensed. Really, the

thought process was 'What is the minimum size of each program space that can

support the student enrollment?'” Laughlin said.

Exploring other options

While the Board of Education has not endorsed any plan other

than a modified space program for a local pre-K-8 school, members are analyzing

what the costs associated with a pre-K-5 only model are from an operational,

tuition, and transportation perspective, Laughlin said.

Toward that end, board members discussed what's involved in

sending Sherman’s middle school students to neighboring districts.

Students in the Sherman school district now choose between

attending high schools in New Fairfield, New Milford and Region 12, which has

students from Bridgewater, Roxbury and Washington. If The Sherman School

decides to eliminate its middle school and send children to neighboring

schools, there would be no more choice.

“The logistics wouldn’t make any sense. So if you were to do

it, one town would take all of our students from sixth grade to 12th

grade,” Vogt said.

Sherman school officials will be working on the full

analysis of cost comparisons in the coming weeks.

"We remain committed to conducting a thoughtful and

deliberate analysis to determine if any alternates are viable based on tuition

cost information provided by potential receiving districts," Vogt

said.

Laughlin said program needs from a building perspective for

a pre-K-5 school compared to those needed for a pre-K-8 school are slightly

different as fewer classrooms would be required.

"However, any potential reduction in square feet would

be relatively small in order to still maintain required programming for

students in grades pre-K-5," he said.

He added based on preliminary information and

considering all factors, it doesn't seem that a pre-K-5 only model would result

in significant operational cost savings, if any at all.

South Windsor schools unveil details of planned athletic field upgrades ahead of hearing next month

SOUTH WINDSOR — School officials have submitted detailed

plans for the proposed

athletic field improvements at South Windsor High School ahead of a

public hearing scheduled in March.

Though the

Town Council decided in January not to set a date for a $7.5 million referendum

to fund the plan, the school district is moving forward with an application to

the Planning and Zoning Commission. The PZC's public hearing is tentatively

scheduled for March 12, the same date that the Board of Education originally

requested that the Town Council set the referendum for.

The centerpiece of the plan is a synthetic turf field with

field lighting, a request from both educators and athletes that has yet gone

unfulfilled.

Chris Hulk, director of design and construction for New

England at turf contractor FieldTurf, wrote in a memo dated Jan. 22 that South

Windsor is the only high school in its District Reference Group without a lit

field.

"This requires students to be dismissed from school

early and miss class time at both South Windsor and for visiting schools so

that they can have adequate daylight for events," Hulk said.

The new multipurpose field would be placed in the area

adjacent to the Wapping Annex, where the high school's tennis courts are

currently located, in order to facilitate an increase in the number fields

on campus and comply with local zoning regulations for athletic field lighting

setbacks.

Hulk said in addition to a new playing surface and lighting

fixtures, the new field would come with bleachers, a press box, accessibility

improvements, and space for more buildings to support the field in the future,

such as a concession stand.

"The new field will address the need for additional

playing space with a lit field, and provide opportunity for the existing,

heavily dated tennis courts to be relocated and replaced," Hulk said.

Hulk said the high school's six tennis courts, built in the

1960s, are in need of "extensive" repairs and are located at the

bottom of a slope far away from parking, limiting accessibility for potential

players.

The seven new tennis courts would be located where the high

school's field currently sits, joined by four new pickleball courts, Hulk said.

"These new tennis courts will meet the number of courts

needed for tennis matches, provide parking adjacent to the courts, accommodate

the growing desire for pickleball courts in the community, and will be fully

installed within the existing developed area of the site," Hulk said.

Hulk said the proposal includes an extra tennis court in

part because the high school's tennis team has seven matches for

each event, meaning that having only six courts forces one match to wait

for another to finish before it can start.

Hulk said in addition to providing more flexible fields, the

project hopes to provide more flexibility in accessing the high school itself.

He said the plan proposes a new driveway from the Wapping Annex parking lot to

the student parking lot to improve emergency vehicle access, increase parking

on campus near the tennis courts, and allow the school more options for student

pickup and drop-off.

Before the referendum date was put on hold, construction of

the project would have begun this spring and into the fall if approved and

funded, though the funding is up in the air. Work would have started with the

synthetic turf and driveway improvements, with lighting work projected during

September and early October.

Mayor Audrey Delnicki said Friday that the Town Council

would likely begin discussing a referendum for the project in June, once

budgets are finalized across the board.

Delnicki said the referendum was delayed primarily because

"we don't have all the numbers," and due to the new Town Council's

unfamiliarity with the plan.

If the town does choose to send the $7.5 million to a public

vote, Delnicki said, the question would likely be included on the ballot

for the November election. She said a benefit of waiting until then for the

referendum is that more people tend to vote on referendum questions during

elections, especially presidential elections.

Delnicki said she also hopes that the delay in the

referendum means more residents will learn more about the project before

voting.

"If there's any groups out there that think this plan

is a good plan, they should be advocating for it so the voters have

information," Delnicki said.

Bridge construction lawsuit against Stonington is over, for now

Carrie Czerwinski

Stonington ― Though the town is no longer a party in a

lawsuit alleging bias and favoritism in the bidding process for a bridge

project, it may still face further action by a woman-owned construction firm.

“We’re exploring alternative claims against the town,”

Thomas Banas, attorney for Old Colony Construction, LLC of Clinton, said on

Friday.

As part of a broader lawsuit filed in March 2023, Old

Colony, owned by Michelle Neri, requested a temporary injunction to stop the

town from moving forward on a project to repair the South Anguilla Road bridge,

but the request became moot when the project was completed before the case

could be litigated.

New London Superior Court Judge Angelica Papastavros

approved a request by Old Colony to dismiss the claim against the town on

Thursday. The rest of the suit is pending.

In late 2022, the town awarded the contract to Suchocki

& Son of Preston, the second lowest bidder on the project, for $16,000 more

than the $322,334 bid from Old Colony.

The remaining portions of the ongoing lawsuit allege that

Wengell, McDonnell, & Costello Inc., a Newington engineering firm hired by

the town to do design work and evaluate bids for the project, demonstrated bias

against Old Colony, undermined the competitive bidding process and violated

state law in evaluating bids.

“Old Colony commenced the underlying action to protect the

integrity of the public bidding process, which Old Colony believes has been

undermined by the actions of the Town and its engineer, Wengell, McDonnell

& Costello, Inc.,” said Banas.

The lawsuit points to two differing estimates for site

management the town received from WMC.

In documents associated with the suit, WMC provided a

$49,100 estimate in Nov 2022, but in a letter to the town eleven days later,

revised its estimate to $115,360, saying it anticipated extra costs for project

management if Old Colony was awarded the project.

Suchocki, who is also named in the lawsuit, completed work

on the bridge late last year at a cost of $358,655. The town also paid WMC

$49,100 for construction management of the project. The claims in the suit do

not allege wrongdoing by Suchocki.

In a January decision on a town request to dismiss the claim

against it, the court said that evidence presented by Old Colony indicated

that, through its actions, WMC may have undermined, or at least called the

integrity of the bidding process into question.

The court pointed to evidence that WMC told the town it

would double its fee if Old Colony was awarded the contract. It said that

increase essentially raised the cost of Old Colony’s bid and that Old Colony

had no way of knowing that WMC fees would contribute to the award decision.

The decision also noted that WMC had based the increase on

conversations with prior customers, did not contact references provided by Old

Colony, and the town and WMC “took no steps to evaluate the experience, skill

and business standing of Suchocki before awarding Suchocki the project.”

Banas said that in denying the town’s motion to dismiss the

case, Judge James Spallone found that Old Colony showed evidence of acts by WMC

that undermined the bidding process. Banas said these actions resulted in harm

to not only Old Colony, but taxpayers who had to pay the higher cost of fixing

the bridge.

A deposition of Jay Costello, president of WMC, indicates

that the company has worked with the town and Suchocki in the past.

Attorneys for WMC did not respond to requests for comment on

the company’s defense against the claims, but Costello said at a late 2022

Board of Finance meeting that he called multiple municipalities that had hired

Old Colony to do similar bridge work over the past four to five years.

He said that the five municipalities that returned his

calls, reported a number of issues that drove up costs, including a large

number of change orders, higher than typical administrative costs and numerous

requests for information.

But in a 2022 report for the town, WMC said references

provided by Old Colony all confirmed that its was of acceptable quality.

During a deposition, WMC Vice President Stephen McDonnell

acknowledged that some of unsatisfactory work it cited by Old Colony dated back

as far as 2006.

In a memo to the board, Town Engineer Christopher Greenlaw

wrote that Old Colony “has a performance history of extended project timelines

and schedules that would drive increases for construction, admin[istration],

and inspection at a minimum.”

He also said the town’s bid documents state that it reserves

the right to not select the lowest bid.

When asked by board members if he had confirmed any of the claims in the WMC report, Greenlaw said he had spoken with a municipality and corroborated the information.

A showdown on a CT airport redevelopment plan looms. Mayor has ‘real serious questions’ on viability

As a showdown on the

future of Hartford-Brainard Airport looms in the legislature, Hartford

Mayor Arunan

Arulampalam isn’t showing his cards just yet, and last year’s

consultant’s report didn’t go far enough in helping him take a position on the

issue.

“It’s a really significant decision and shouldn’t be made

hastily,” Arulampalam said. “I always support further development of properties

that we have here in Hartford. But I have real serious questions about the

viability of development on the Brainard parcel.”

A

consultant’s $1.5 million study late last year concluded that the

200-acre airfield in Hartford’s South End could be used for industrial or

mixed-use redevelopment. But it could cost tens of millions to rid the airport

of contamination and take years to decommission it before fully reaping property

tax and economic development potential, according to the report.

Instead, the Brainard

Airport Property Study recommended keeping the airport open and

extending one of its runways.

But this alternative — one of four outlined in a final report — calls for the closing of a lesser-used runway and redeveloping the area primarily for warehouse and industrial uses. That would build on what already exists in and around the airport in the city’s South End, according to the report, prepared by BFJ Planning of New York.

A hearing on the study is expected — but not yet scheduled —

in the legislature. State lawmakers then would have to decide whether the

century-old Brainard should be closed.

The state-financed study, conducted over eight months, has

drawn sharp criticism from Sen. John W. Fonfara,

D-Hartford, a longtime proponent of closure and mixed-use redevelopment.

Fonfara, who unsuccessfully ran for Hartford mayor last year, has said the

study relied too heavily on previous studies that assessed environmental

clean-up and economic development prospects for the airport.

Arulampalam said he is concerned about the depth of BFJ’s

assessment on underground contamination and the impact on the dike along the

Connecticut River.

“And then, there is the timeline for deactivating and going

through that process,” Arulampalam said. “The challenges are significant. If

they are outweighed by the potential for redevelopment, then I would be very

open to it. But, as it is now, given the level of information we have, I think

serious questions still persist.”

If state lawmakers decided to close Brainard, the approval

of the Federal Aviation Administration would

still be needed.

Arulampalam’s caution stands in dramatic contrast to his

predecessor, former Mayor Luke Bronin, who was a strong supporter of

redevelopment and campaigned on the issue prior to the first of his two terms

as mayor.

But Bronin also became one of the targets of a lawsuit from

businesses at Brainard. The lawsuit argued that all the talk of closure hurt

profits and stymied expansion and attracting new customers. The lawsuit

is pending.

Decades of debate

The debate over the future of Brainard has resurfaced

periodically since the 1950s when half of the airport was taken for

redevelopment. The current push for redevelopment of Brainard comes at a time

when towns along the Connecticut River in greater Hartford are renewing their

focus on mixed-use development along the riverfront.

The most ambitious is a sweeping, $850

million, mixed-use redevelopment of East Hartford’s Founders Plaza into

as many as 1,000 apartments over a period of years.

In Hartford, the debate over Brainard also comes as the

state examines what should be done with an adjoining 80 acres that will become

available with the decommissioning

of Hartford’s trash-to-energy plant.

“You have 300 acres on the Connecticut River,” Fonfara said.

“Imagine what we could do there for young people who want to stay, who want to

work here. But they don’t have much to do in the nightlife. We don’t have

anything comparatively.”

In addition to housing, Fonfara’s vision, which would unfold

over a period of years, includes entertainment venues, restaurants and other

attractions. The development also would provide a sorely-needed boost to the

property tax base, Fonfara said.

Fonfara disputes the contention in the BFJ report that there

isn’t enough housing demand to support a mixed-use redevelopment of Brainard.

He points not only to an aggressive push in downtown Hartford for more

apartments amid high occupancy, but also in East Hartford and West Hartford.

“But our proposal — this proposal — makes no sense?’ Fonfara

said.

The quasi-public Connecticut

Airport Authority, which owns and oversees operations at Brainard, issued a

statement, saying it will be watching for any further action by the

legislature.

“The recent consultant report speaks for itself, and it is

now up to the legislature to decide if it deems it appropriate to act further

on this matter,” the CAA’s statement reads. “In the meantime, the CAA plans to

continue operating a safe airport for the benefit of its tenants, users and the

regional economy.”

Options in the report

The BFJ report said the recommended option would dovetail

with the industrial nature of the area surrounding Brainard Airport, which

includes a wastewater treatment plant. The alternative also could be achieved

swiftly, potentially in one phase, the report said.

The proposed structures under the recommended option include

a 100,000-square-foot building split equally between flex industrial and

advanced manufacturing spaces; another 100,000-square-foot structure dedicated

to industrial or manufacturing purposes, and a 20,000-square-foot retail area.

The three other options are:

♦ Keeping the airport open with

limited development with a runway extension, new air traffic control tower,

hangars and 94,000 square feet of aviation-related space.

♦Closing the airport and

pursuing the addition of 2.6 million square feet of industrial space, 140,000

square feet of office space and 100,000 square feet of “accessory retail.”

♦Closing Brainard for a massive,

mixed-use redevelopment that could have 2,700 units of rental housing,

105,000-square feet of retail, 262,000 square feet of industrial space and

255,000 square feet of indoor and outdoor recreation venues.

According to BFJ, total development costs range from $46

million for the recommended option to $1.4 billion for the mixed-use

alternative. These numbers do not include the use of public subsidies in the

calculations. Typically in the Hartford region, projects such as these receive

subsidies of at least 20% of the total project cost in order to be financed due

to market conditions and cost of construction, BFJ said.

Organized Opposition to Closing

The latest push to close and redevelop Brainard has spawned

significant, organized opposition — giving rise to the Hartford Brainard Airport Association.

The association, whose members include pilots, Brainard

tenants and others, have pushed back against airport being cast as a

“playground for rich folks” with single- and twin-engine planes. The

association also argues that Brainard is crucial for its pilot training schools

and should be invested in as an asset to promote economic development in the

region. The airport could be a center for developing new aviation and

transportation technologies.

The association also predicted the findings in the BFJ

report would be no different than a legislative study conducted in 2016 that

recommended Brainard stay open. That study never came to a legislative vote,

dismissed by those who support redevelopment, including Fonfara. Fonfara has

argued the 2016 report was not conducted by those who had the specialized

expertise that was necessary.

While the association was happy the BFJ report recommended

Brainard stay open, it opposes the closure of one of the runways, a move that

the association would hobble further growth.

The association “continues its position of keeping the

airport open and growing it substantially to make it an economic benefit for

the city of Hartford and the greater Hartford region,” Michael Teiger, a

Hartford pulmonologist, who leads the association, said. “We certainly don’t

want to decrease the size of the airport by closing a runway. We want to see it

grow to its fullest potential. We believe the potential is huge and needs to be

encouraged.”

More lanes bring more traffic, folks, not less

I love doing radio interviews, literally “talking

transportation.”

Of course, having worked in radio for 15 years and then

spending 40 years teaching people how to survive media encounters, I’m at

something of an advantage. But I do love to turn naïve questions into learning

opportunities.

Case in point, this recent exchange:

“So Jim… How do we solve the traffic problem on our

interstates and parkways?” asked the radio talk show host. “Is there

room for adding another lane?”

“That’s not the answer,” I said. “Adding lanes to

crowded highways just makes them more crowded. Maybe not immediately, but

within a matter of weeks or months.” The radio host didn’t believe me, but

history proves my point: if you build it, more cars and trucks will come.

Planners and economists call it “induced demand.” By increasing the supply of something

(in this case highway lanes) you in effect lower the price (time spent driving)

and up goes the demand (bringing more traffic, more delays).

Consider this analogy:

A local store is giving away free food. The crowds soon

swarm the establishment, muscling out those really in need. If the store

is our highways and accessing them is free (no tolls), it’s no surprise they’re

jammed. The only real cost involved in driving is fuel and time: the

hours you waste in bumper-to-bumper traffic.

Building highways is also really expensive, especially here

in Connecticut. The Connecticut Department of Transportation’s plans to

rebuild the I-84/Route 8 “Mixmaster” in Waterbury came in at between $7 and $8

billion. Now certainly, maintaining existing roads and bridges in the

proverbial “state of good repair” is a must. But expanding the highways

isn’t the solution to handling more traffic.

There are two answers: tolls and trains.

Driving on our freeways at rush hour shouldn’t be

free. Charge for the privilege and you’ll moderate the demand. Some may

chose to time-shift their travel, but others may take alternatives, like our

trains.

Interstates 95 and 91 are both paralleled by robust train

lines priced to encourage ridership. Intrastate fares are kept deliberately low (Bridgeport

to Stamford is just $5 one way and New Haven to Hartford is only $8.25, not

factoring in multi-trip commuter discounts.)

The billions of dollars not spent to widen those crowded

highways would subsidize a lot of train rides. But getting to your home

station and from your destination station to work/school (the “first mile/last

mile” challenge) is an additional expense that should also be underwritten.

That’s how New York City’s impending “congestion pricing”

revenue will keep funding the bus and subways. Those willing to pay the

price for driving in midtown should see less traffic and a faster

trip. Nobody is suggesting widening New York City’s highways.

So, sorry all you talk show experts out there, the solution

to our crowded highways isn’t wider highways. The simple mantra “adding

one more lane should solve our problems” is just a never ending race to

Carmageddon.